In the last three months, Bitwise Assets Management has completed its second acquisition of a European Union`s crypto firm by a US financial group. The US-based crypto currency fund manager has finalised an agreement to get hold of the Ethereum Classic (ETC) Group of London, which is their first step towards expansion on the European continent, and this information came forward during Monday`s session.

The agreement further illustrates how this is a significantly broader United States investment market that is driving the extension of American institutions into the European Union, while prominent asset managers like Black Rock, Vanguard, and Fidelity have already secured top-notch positions in these fields. The agreement proceeds after Robin Hood, a California-based retail broker, smashed up the European Union`s Bitstamp by 200 million U.S. dollars, which is a cryptocurrency exchange in Europe, during the month of June.

After seven years of its founding, Bitwise is now expanding, following the launch of two of the first Bitcoin and ethereum coin exchange traded funds (ETFs) in the United States. Basically, it might not have the scale or the name recognition of some of the broader competitors, but the Bitcoin ETF of Bitwise has already accumulated an excess of 2 billion U.S. dollars since its initial stage.

During the press conference, the Chief Executive Officer of Bitwise, Mr. Hunter Horsley, stated that the acquisition has enabled Bitwise`s capabilities to cater to European investors, provide a worldwide closer view of their clients, and broaden the product assistance with the help of pioneering exchange-traded funds (ETFs).

Bitwise has anticipated that their assets, which are under management, will be able to reach about 4.5 billion U.S. dollars. This will be Bitwise`s first agreement on the European continent. The employees of the ETC Group will continue their cooperation with the company, while their crypto commodities will be reorganised and relabelled under the Bitwise name.

Co-founder of the ETC group and chief strategist, Mr. Bradley Duke, has stated that trust in Bitwise must go on while it is trying to establish itself as one of the top-ranked firms in the budding asset class and has constantly confirmed its professionalism and leadership qualities over the years. Bitwise Group and ETC Group have shared a common approach to the business, which focuses solely on digital assets and crypto commodities.

Mr. Duke has also explained that while Bitwise`s presence is exclusively in the United States, the ETC group`s completely focused on the European Union to make it a stronger partner of theirs. Outside of the European Union, ETC Group`s operations are within the limits that provide distribution within regions such as the Middle East, Africa, and Asia, and their commodities are not recorded or licensed within the United States for the sales.

ETC has been able to manage around 1.1 billion U.S. dollars from its nine crypto exchanged operations domiciled in Germany, which is around 950 million U.S. dollars of the total coming from its flagship physical Bitcoin ETP (BTCE).

An Ethereum classics (ETCs) offering has to take account of the funds cantered on second-tier crypto currencies such as Solana, Litecoin, and Cardano; they go beyond the recommendations given by the United States; they only allow first-tier crypto currencies such as Bitcoin and Ethereum ETFs, which is an opportunity for Bitwise, which helps them to expand their venture within the new areas.

Duke has also noted that the European Union is more flexible than the United States, which provides an advantage to Bitwise in introducing some of their commodity plans to life through the issuer. The European market is too advanced, which offers a broader selection of approved crypto currencies and also includes commodities and ETPs that involve ventures.

Bitwise has a complete portfolio of around 20 commodities, which includes a major crypto index private placement vehicle that independently manages account funds, private-based funds, and ETFs. The terms and conditions of the agreement are yet to be disclosed.

Mr. Horsley has expressed his pride in the reputation that Bitwise has created in the last six years as a complicated asset manager in crypto markets, basically among advisers, institutions, and retail investors. The company is all set to expand its proficiency among European investors, he says.

Mr. Duke expressed his sorrow over seeing the brand disappear but the customers are waiting for the new owner to arrive and the opportunities that might come with being part of a larger, mostly globally accepted digital asset based company.

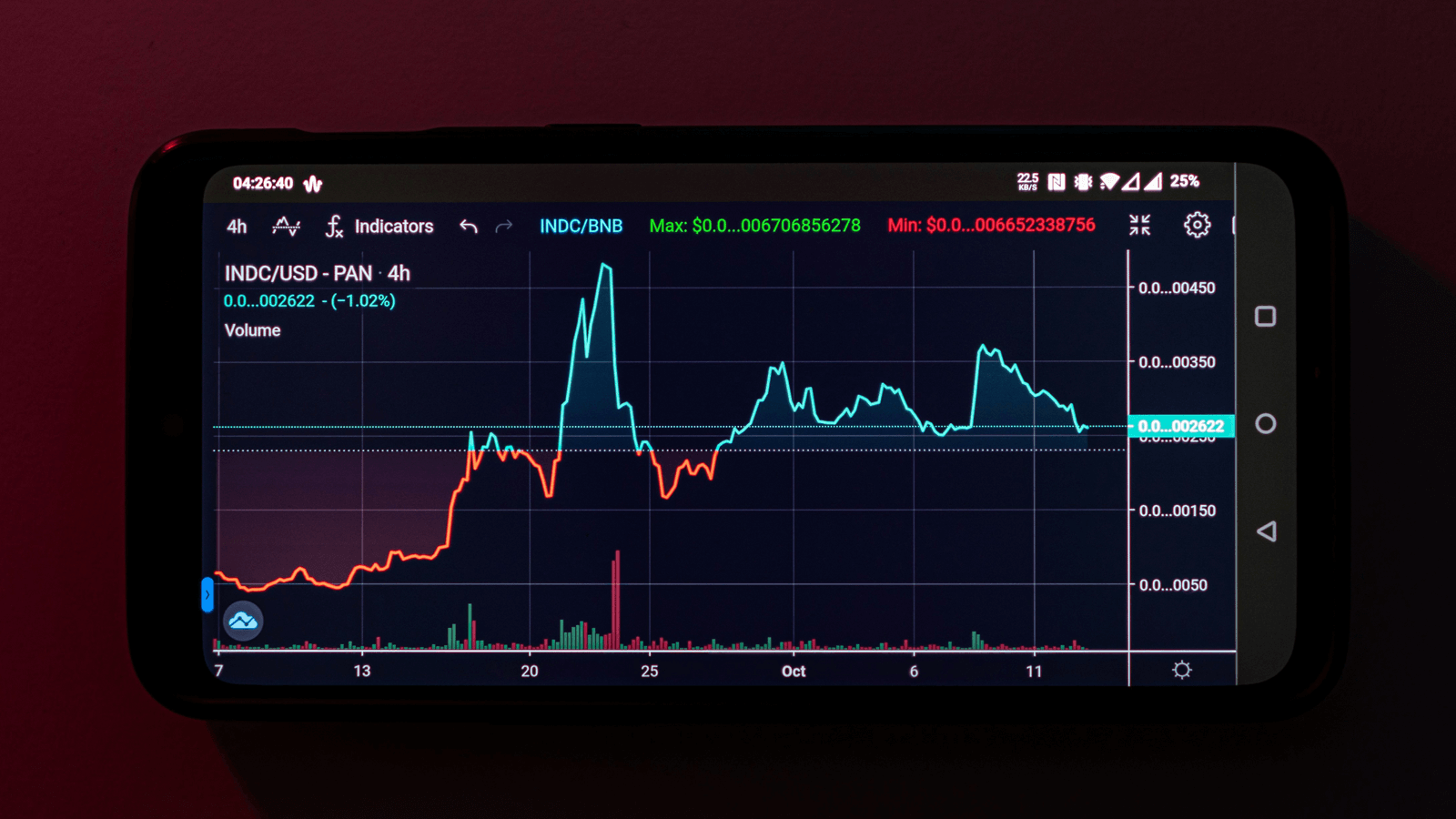

Bitcoin has witnessed a gain of around 70000 U.S. dollars in the months of March, May, and June, but since then the decline has started, and it has to settle at 59000 U.S. dollars, but it still remains up by around 34 percent compared to January`s data. Ethereum prices have also witnessed some gains this year.

Link: https://www.ft.com/content/11bb0265-f952-4e10-925c-d51866fc16ee